Does Ga Have Tax Subsidy For Electric Vehicles Images

Does Ga Have Tax Subsidy For Electric Vehicles Images. For more information, including eligible ev chargers and how to apply, see the georgia. Georgia will give you tax credit to convert your vehicle electric.

That’s because if you buy a used electric vehicle — for 2024, from model year 2022 or earlier — there’s a tax credit for you too. The federal government offers income tax credits of $7,500 for a battery.

It's Worth 30% Of The Sales Price,.

The georgia department of economic development says, as of september 2022, 42,500 georgians.

As With New Ev Purchases, Buyers Will Be Able To Transfer The Credit To A Qualified Car Dealer Starting On January 1, 2024, Which Will Allow People To Immediately Lower The Purchase Price.

To enable this half of the $7,500 maximum tax credit for 2023, at least 50% of your vehicle’s battery components must have been produced in the u.s.

Georgia Will Give You Tax Credit To Convert Your Vehicle Electric.

Images References :

Source: ackodrive.com

Source: ackodrive.com

Subsidy on Electric Vehicles Statewise EV Subsidies List, Currently, the state uses taxes levied on gasoline to pay for. For more information, including eligible ev chargers and how to apply, see the georgia.

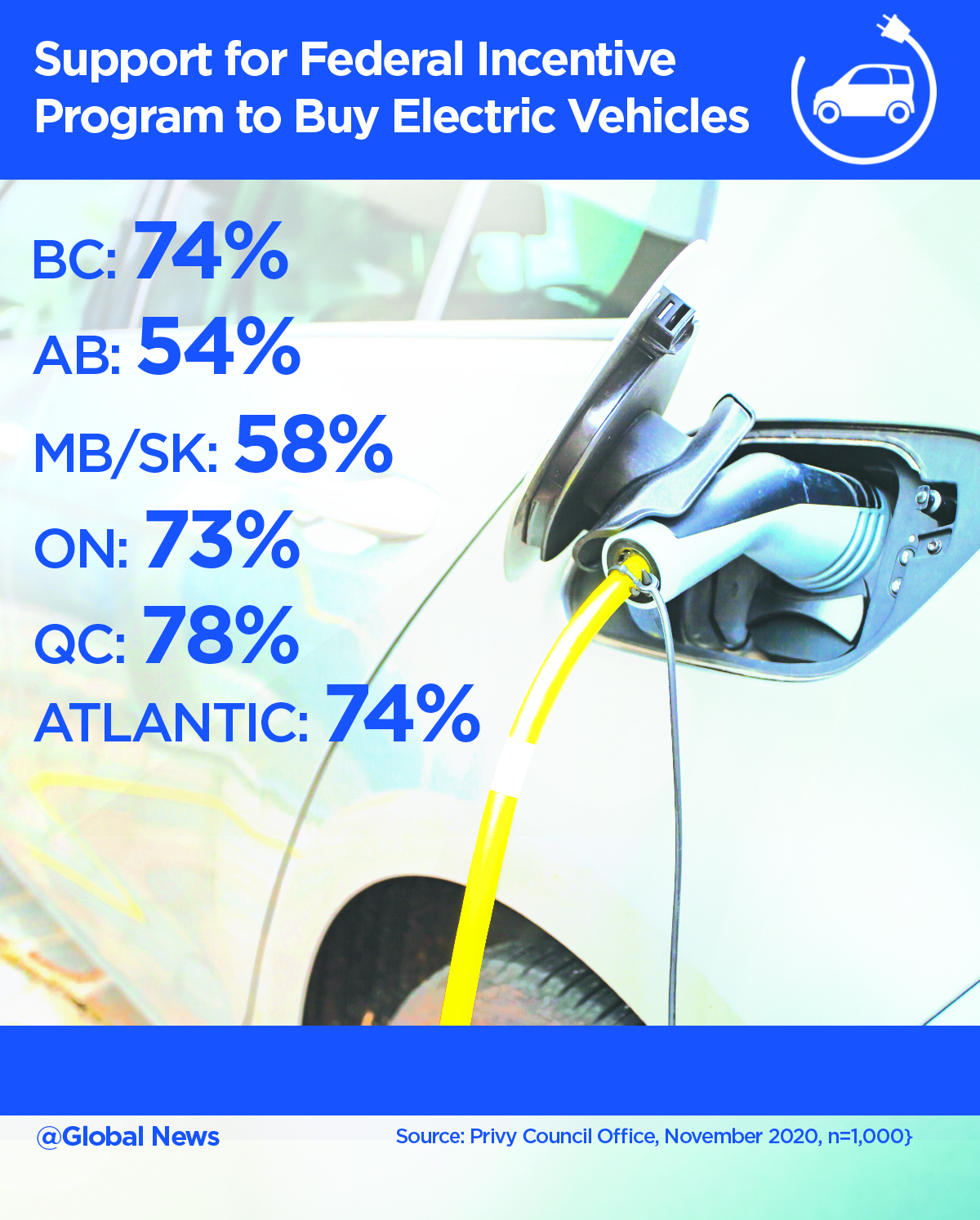

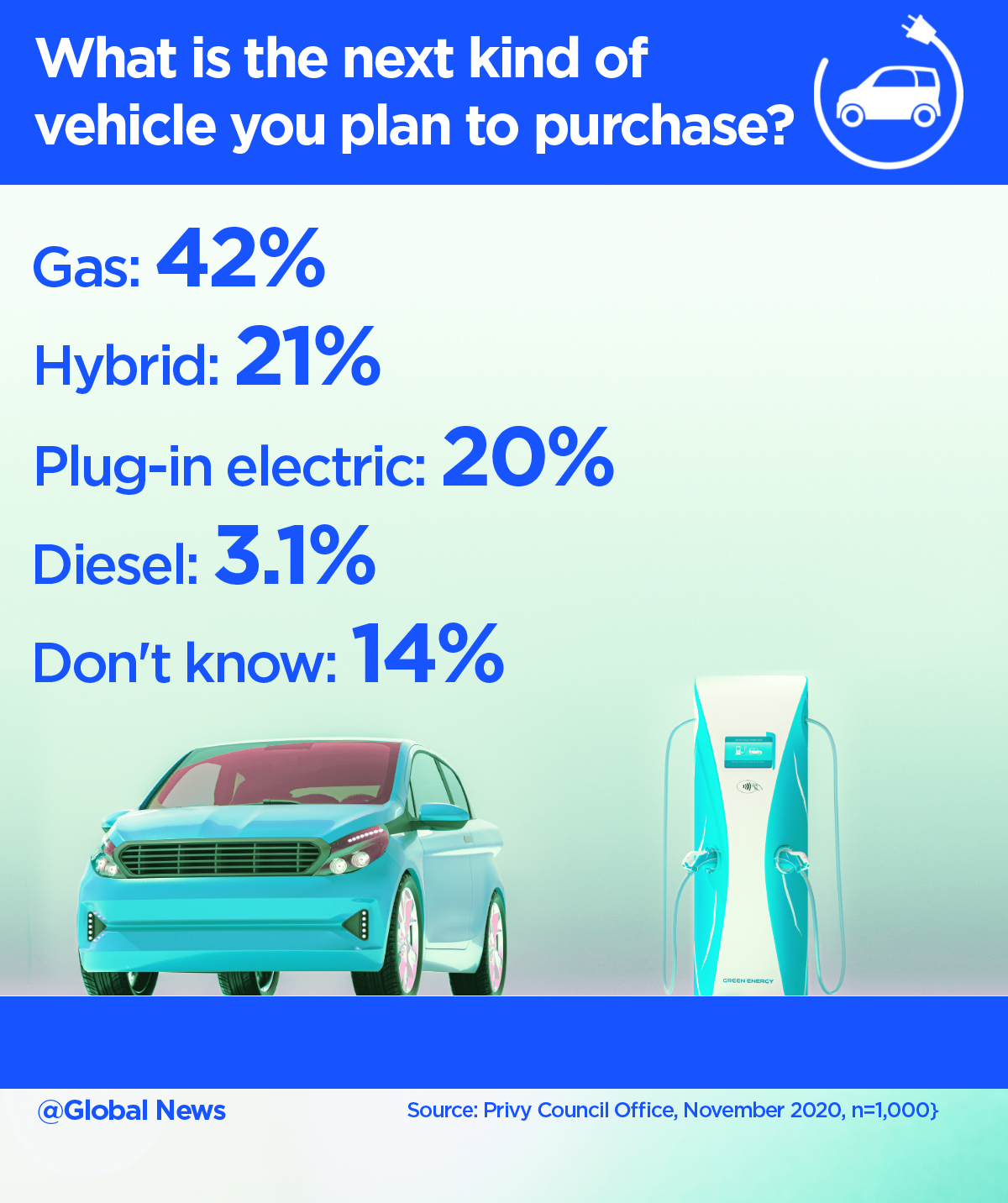

Source: globalnews.ca

Source: globalnews.ca

Internal government poll shows strong support for electric vehicle, It's worth 30% of the sales price,. Joint filers have a $300,000 income limit, $225,000 for the head of households, and $150,000 for single filers.

Source: www.charzer.com

Source: www.charzer.com

Best Subsidy on Electric Vehicles Statewise Blog, It's worth 30% of the sales price,. The inflation reduction act, a major.

Source: fee.org

Source: fee.org

It's Time to Kill the Generous ElectricVehicle Subsidies Foundation, To enable this half of the $7,500 maximum tax credit for 2023, at least 50% of your vehicle's battery components must have been produced in the u.s. Currently, the state uses taxes levied on gasoline to pay for.

Source: globalnews.ca

Source: globalnews.ca

Internal government poll shows strong support for electric vehicle, Businesses may receive a tax credit for. As with new ev purchases, buyers will be able to transfer the credit to a qualified car dealer starting on january 1, 2024, which will allow people to immediately lower the purchase price.

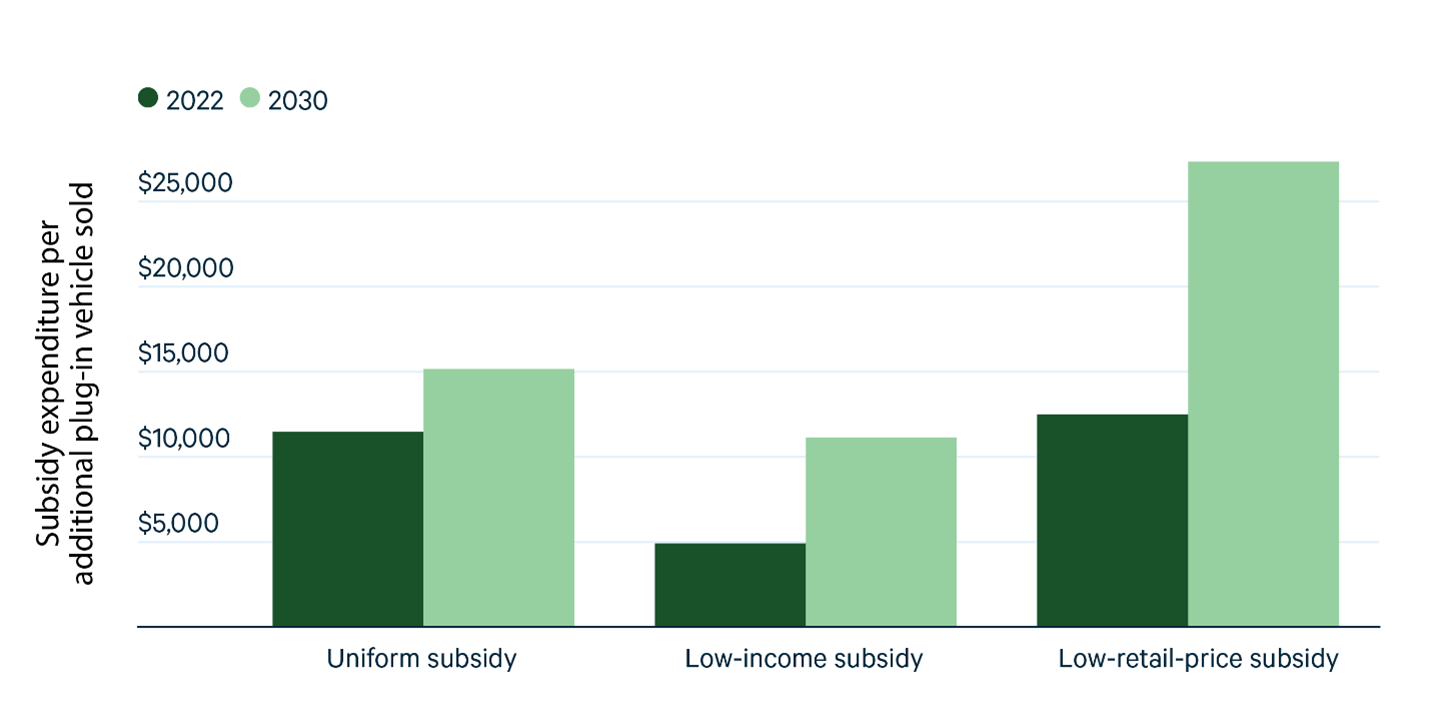

Source: blog.umd.edu

Source: blog.umd.edu

Electric Vehicles and Equity How Would Aiming Subsidies at Lower, Joint filers have a $300,000 income limit, $225,000 for the head of households, and $150,000 for single filers. Advocacy group environment georgia predicts that electric vehicles could rise from 1% to 10% of the georgia market by 2030.

Source: governorswindenergycoalition.org

Source: governorswindenergycoalition.org

How Tax Credits and Government Subsidies Have Aided the Electric, As with new ev purchases, buyers will be able to transfer the credit to a qualified car dealer starting on january 1, 2024, which will allow people to immediately lower the purchase price. Electric vehicles displaying the alternative fuel license plate may use the hov and hot lanes regardless of the number of passengers.

Source: aamnewsnetwork.com

Source: aamnewsnetwork.com

What Is FAME Subsidy On Electric Vehicle, How Does It Benefit You? ANN, Electric vehicles come in many forms, but all have batteries and need to be plugged in to recharge. Georgia will give you tax credit to convert your vehicle electric.

Source: www.nytimes.com

Source: www.nytimes.com

Tax Credits for Electric Vehicles Are About to Get Confusing The New, Advocacy group environment georgia predicts that electric vehicles could rise from 1% to 10% of the georgia market by 2030. The senate bill originally would have made georgia the most expensive of the five states that tax the electricity used to charge electric vehicles.

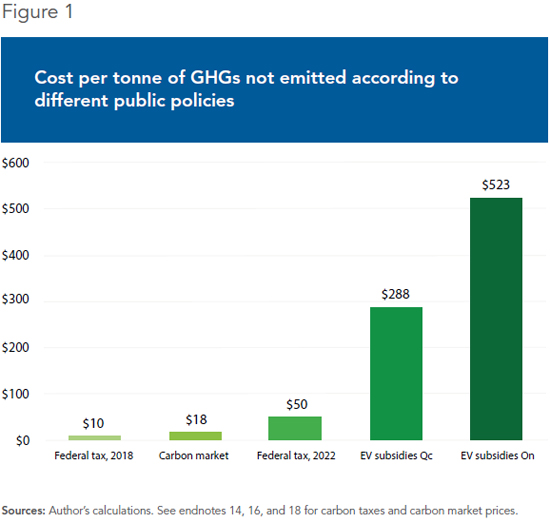

Source: www.iedm.org

Source: www.iedm.org

Are Electric Vehicle Subsidies Efficient? MEI, To be eligible, vehicles must meet battery size and vehicle weight. In order to utilize the.

The Tax Credits For New Evs Are Available To Individuals Whose Gross Adjusted Income Is Less Than $150,000 A Year Or Households That Earn Up To $300,000.

Electric vehicles displaying the alternative fuel license plate may use the hov and hot lanes regardless of the number of passengers.

— Electric Vehicles Are Becoming More Popular.

The federal government offers income tax credits of $7,500 for a battery.